Street rates for self storage units in the U.S. remain above pre-pandemic levels, despite the expected seasonal slowdown. Data from Yardi Matrix shows that the average national street rate for both non-climate-controlled and climate-controlled units was $142 in November, a 0.7% year-over-year decrease. However, street rates are still up more than 10% compared to pre-pandemic rates, and overall occupancy remains high.

The rest of this article breaks down what may be in store for self storage in 2023.

Possible development slowdowns ahead

The development rate is expected to slow if banks hesitate to write new construction loans. This would result in a decline in new starts once current projects are completed. Rising interest rates may lead to a downturn in the economy in late 2023, which could potentially impact the self storage sector.

How top self storage metros are performing

On a monthly basis, street rates declined nationally and in most metros through November. Around 84% of Yardi Matrix’s top 31 metros saw a month-over-month decrease in street rates for 10×10 units in November. The largest decreases were in Philadelphia and Pittsburgh, with rates falling by 6.2% and 4.4% respectively for 10×10 non-climate-controlled units. Climate-controlled units, which generally rank among the top self storage features tenants want today, saw even larger declines, with rates dropping by 6.3% in Philadelphia and 8.3% in Pittsburgh.

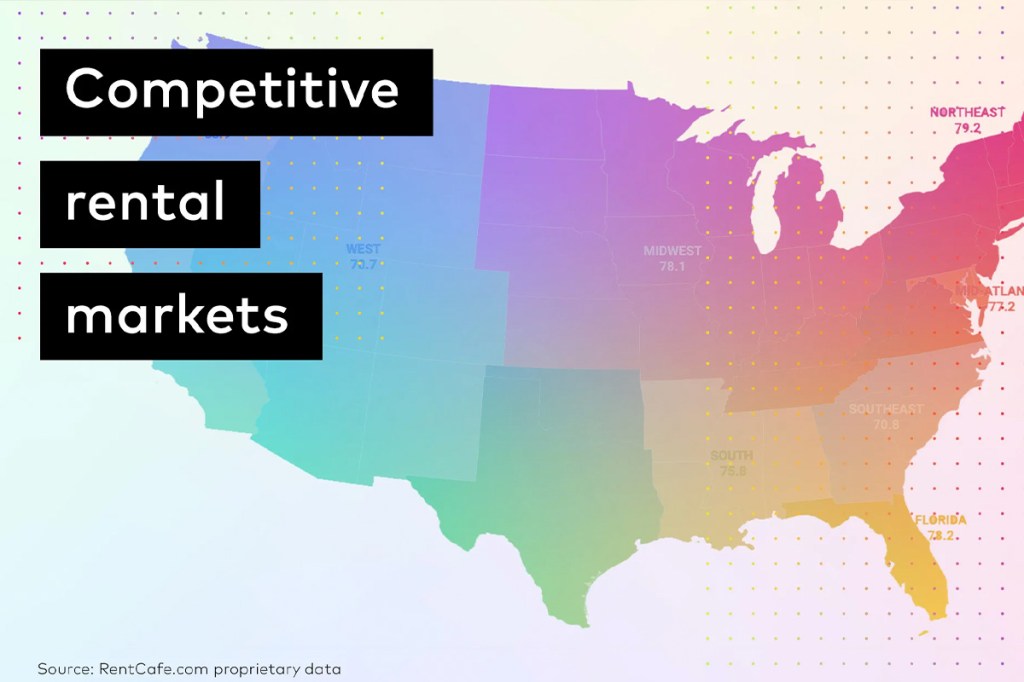

To reiterate, street rates have slowed but remain above pre-pandemic levels thanks to strong demand and high occupancy rates. However, it will be important to monitor for a potential for a downturn in the economy. (Signs of which would include slowdowns in the development pipeline.) Despite potential challenges ahead, the self storage sector should be well positioned relative to other rental markets.

Best- and worst-case scenarios for self storage markets in 2023

In the most optimistic scenario, markets continue to perform well in 2023, with high occupancy rates and increasing rates for existing customers. The development pipeline will still slow, but the labor market will remain tight. If inflationary pressures ease, we expect to see continued stability in the sector.

On the other hand, rising interest rates could lead to a downturn in the economy in mid-to-late 2023. This could cause a decline in demand for self storage units. Occupancy rates and street rates could fall, and the development pipeline could slow even further as banks become more hesitant to write loans. This slowdown would occur alongside the real estate market as a whole. Still, it’s important to remember that self storage tends to perform better than other sectors during recession periods.

Facility management software unlocks your potential

Self storage and facility managers can recession-proof their business by being smart about how they use technology. Facility management software is the most obvious and important option as it’s a single source for text and email communications, rent collection, lease management, budgeting, reporting, stored goods protection plans and more. If you think you may need to tighten your budget in 2023, an investment in the right software will help you stay on track.