This article was originally published by Laura Calugar in MHN Multi-Housing News. See the original version here.

The manufactured housing industry has been on an upward trajectory in the past decade. Drawn by the strong and stable income of manufactured home communities, an increasing number of institutional investors and owner-operators have been diving into the sector. And during periods of economic uncertainty, this asset type is very resilient because it provides a much-needed affordable housing option.

“Mobile home parks are historically a recession-proof asset due to the shortage of affordable housing across the country,” Kevan Enger, partner & manufactured housing director at Capstone Cos., told Multi-Housing News. “It does well in good times and even better in bad times when there is more demand for cheaper housing options.”

And when times get rough, affordability is key to success, according to HARRI5 Founder & Principal Derek Harris. The national commercial real estate brokerage company specializes in manufactured housing communities and has facilitated more than $1.8 billion in mobile home and RV communities since 2015. Last year, the company brokered $600 million in MHC sales and escrows involving 30 properties across the country and 7,200 sites.

In 2022, investors compressed cap rates to levels that would have been deemed “laughable” 12 to 18 months earlier, according to Don Vedeen, vice president for national manufactured housing investment sales with Northmarq. But rapidly increasing interest rates threw a wrench into investment volume in the second half of the year.

“Many investors put a full stop on acquisitions, which has slowed the market down,” Vedeen said.

Trends in the MHC industry

The first half of the year will be challenging for investors because of the lack of alignment between buyers and sellers, Harris believes. The bid-ask spread is still wide, with many investors adopting a wait-and-see mode.

“Buyers are looking at the higher interest rates as an opportunity to buy properties at a higher cap rate or lower valuation,” said Vedeen. “The problem is that owners have grown accustomed to having brokers ‘wow’ them with inflated values and that isn’t happening right now. Buyers are looking for a deal, while sellers are holding onto hope of a large sale price … I see this as a waiting game to see who gives in first, buyers or sellers,” he added.

One trend that is emerging as a result of the volatile debt market is owners looking to develop and infill their existing parks vs. closing new deals. Havenpark Communities, an operator and developer of manufactured home communities, added 870 affordable homes across its portfolio last year and intends to install another 800 in 2023.

“(Havenpark) is committed to being part of the solution to America’s acute housing affordability challenge by continuing to bring new housing supply to the communities we serve,” said Havenpark Communities CEO & Co-Founder Robbie Pratt.

In November 2022, 65 new lots were added to Havenpark’s West Branch Village Community in Iowa City, Iowa. The new homes included two- and three-bedroom layouts, with prices starting at $79,900.

U.S. Census Bureau data shows, as of May 2022, more than 50,000 manufactured homes were shipped across the country, marking a 31% year-over-year increase.

“Prefabricated construction, which includes modular, manufactured and mobile homes, has for years been used in lower-budget housing development,” said Doug Ressler, manager of business intelligence, Yardi Matrix. “But with rising interest rates and higher prices for materials such as lumber, the process is starting to get more of a toehold in the mainstream apartment market,” he continued.

As demand climb, so do prices. Census data also shows that the average sale price of a manufactured home in the U.S. in May 2022 was $124,900 — up from $85,900 in May 2020. Despite the price increase, manufactured homes still remain a significantly more affordable option than owning an apartment or a single family home. That spread is constantly fueling demand for the asset type.

Some city officials are looking at more of these projects as a way to mitigate the U.S. housing shortage as financing traditional housing development becomes increasingly difficult, Ressler noted.

“There needs to be more regulation allowing manufactured housing to increase its supply,” Vedeen also pointed out.

Northmarq has been involved in several manufactured housing developments over the past few years, but they noticed that compared to traditional apartment developments, new manufactured housing communities are almost nonexistent. In Texas alone, the brokerage estimated that some 20,000 MHC units were at some stage of development at the beginning of this year, but the need for affordable housing in the state is incomparably higher.

“Just Googling affordable housing need in Texas shows a need for over 600,000 rentable units right now,” Vedeen said. “Manufactured housing could help that but the red tape to get the communities built is exhausting.”

Manufactured homes investment in 2023

As costs for traditional multifamily development remain high and economic volatility persists, demand for manufactured homes is anticipated to keep climbing this year. Competition will likely be very fierce among institutional owners and operators as the number of for-sale properties on the market is expected to be limited.

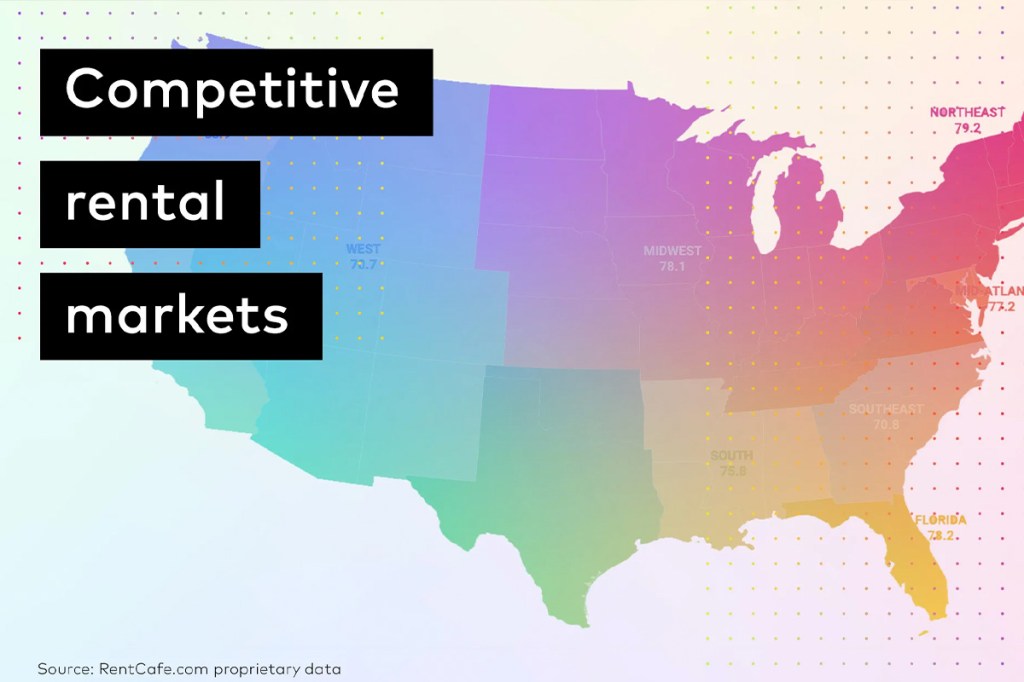

HARRI5 sourced 17 MHC off-market sales last year and intends to continue to expand into new markets going forward. The states that are growing the fastest are among the most coveted areas for manufactured homes investment. There’s high demand for MHC assets across the Sun Belt and the Southeast, with the Gulf Coast seen as an emerging market by Capstone Cos. HARRI5 expects to see increased transaction activity in North Carolina and Washington, while Northmarq believes investors will mostly continue to search for deals in Florida because of its large senior citizen population.

“Investors need to plan for the long term,” Vedeen said. “I envision the market to continue to cool down in the first and the second quarter, but I think at some point a domino will fall and investors will begin buying again and compressing cap rates despite the interest rates,” he added.

Engers also expects debt markets to stabilize sometime in the first half of the year, ramping up both transaction and development velocity. Meanwhile, Harris remains more cautious and looks at 2023 with less enthusiasm when it comes to MHC investment sales.

“We will remember 2023 as a blip on the radar,” he concluded.