When we look at annual rental market data, we’re not just identifying where the competition exists. We figure out why it exists.

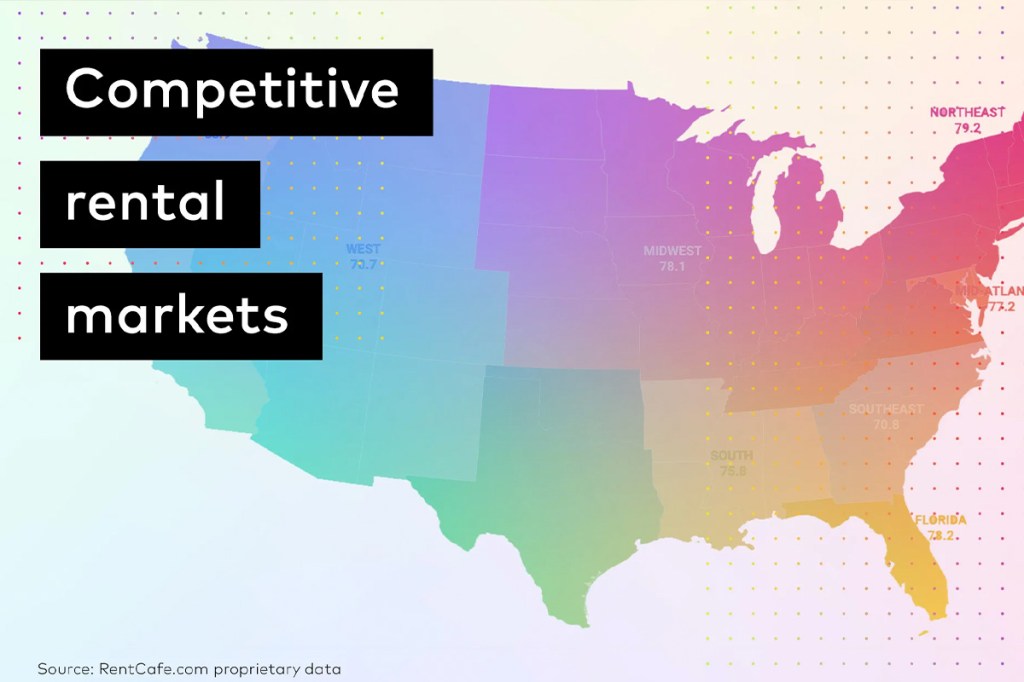

This rental market update is based on a Rental Competitiveness Index (RCI), which looks at markets using five key metrics. The two most significant factors are apartment occupancy and lease renewal rates. These indicate how tight a market is (and how likely current renters are to stay put).

The report also looks at how long apartments remain vacant, how many prospective renters are competing for each unit and the number of new apartments getting built.

Know that accuracy is our highest priority. We analyze data from market-rate, large-scale multifamily properties with at least 50 units. The information comes directly from Yardi and covers 139 rental markets across the U.S.

The most competitive markets in 2024

In 2024, there was a clear winner for the hottest rental market: Miami. Occupancy hit 96.5% — with a steady influx of new residents — and 72% of existing renters renewed their lease.

Even though it’s holding steady as America’s most competitive area, Miami’s lead may be narrowing. Other markets (particularly in the Midwest) are seeing increased competition.

Check out the 10 most competitive markets from a year in review:

- Miami, FL

- Suburban Chicago, IL

- Milwaukee, WI

- Bridgeport-New Haven, CT

- Grand Rapids, MI

- North Jersey, NJ

- Chicago, IL

- Suburban Philadelphia, PA

- Omaha, NE

- Silicon Valley, CA

View the RentCafe.com report to see a list of the top 30 markets.

What’s driving leasing growth in these areas?

So, we know which areas renters are facing the toughest competition, but what’s fueling it? We’ve identified three trends:

- There’s a notable shift in regional dynamics. The Midwest is emerging as a booming rental market (claiming nine spots in the top 30), which is driven by a combination of factors. That includes lower living costs that appeal to remote workers, plus a growing focus on technology and manufacturing sectors. It’s also home to ongoing corporate relocations.

- New construction isn’t moving the needle. Despite a 2.6% increase in available apartments nationwide, we’re seeing higher lease renewal rates (around 62%). This suggests that even with more inventory, renters are choosing to stay put. It’s likely due to factors like high mortgage rates and increased competition for available units.

- Smaller rental markets are seeing job growth. There’s an increase in employment opportunities in areas with limited housing supply. This attracts renters and in turn, increases the competition. The Northeast is a particularly strong indicator, with Lehigh Valley, Pennsylvania (a small rental market), showing an 81% lease renewal rate.

Projected trends for the year ahead

For 2025, experts are anticipating slightly decreased competition thanks to an influx of new rental apartments.

That said, high lease renewal rates are expected to hold steady. Especially in regions where home ownership remains challenging due to elevated prices and mortgage rates.

Watch the recording

Leverage the data with expert help

Here’s what you really need to know: Rental competition is strong, and it’s up to you to stand out from the crowd.

A foundational ILS like RentCafe.com can help.

Good luck and happy leasing!